10 Differential Decision Making

Learning Objectives LO

LO1 Define differential decision making

LO2 Identify relevant and irrelevant costs of differential decision making

LO3 Prepare the analysis for an add or drop a segment decision

LO4 Prepare the analysis for a make or buy decision

LO5 Prepare the analysis for a special order decision

LO6 Prepare the analysis for a sell or process further decision

Differential decision making LO1

Informed decision making is required to effectively run an organization. Managers must decide what products or services to sell, what prices to charge, what assets to purchase, and how to maximize profits. In most cases, managers are choosing between at least two competing alternatives. Therefore, effective managerial decision making aims to compare the costs and benefits of the alternatives and select the alternative that yields the most benefit to the organization.

When a manager is comparing the costs and benefits of competing alternatives, they only need to consider relevant financial data. Generally, managerial decisions are based on relevant costs or benefits. Relevant costs or benefits are defined as costs or benefits that differ between one or more alternatives. Differential decision making is the process of analyzing relevant costs and benefits to make managerial decisions.

This chapter focuses on using relevant costs to make specific managerial decisions. Identifying relevant costs and benefits for differential decision making is covered in the next section. Differential decision making tools for four common managerial decisions are covered in the remaining sections. Specifically, tools used to inform the following decisions are illustrated: adding or dropping a segment; making or buying (outsourcing); accepting or rejecting a special order; and selling or further processing a joint product.

Check your understanding LO1

Relevant and irrelevant costs of differential decision making LO2

Relevant costs or benefits are defined as costs or benefits that differ between alternatives. If a cost or benefit does not differ between alternatives, it is not considered relevant to the decision. If a cost or benefit differs between alternatives, it is considered relevant to the decision.

The theory underlying the use of relevant data is that costs or benefits that do not differ would not change regardless of which decision is made, so they are irrelevant. Since the costs are the same regardless, it is unnecessary to consider them when deciding between two or more alternatives. Irrelevant costs or benefits are considered unavoidable, whereas relevant costs or benefits are considered avoidable.

To illustrate the concept of relevant costs, assume that Kendra is deciding if she wants to make dinner at home or go out to dinner. Kendra does not need to compile all of her personal financial information, e.g., income, rent, and other expense data, to make this decision. Her income and monthly rent payment are the same regardless of whether she makes the meal or goes out to eat. Since these costs are the same for both alternatives, they are irrelevant.

Only the costs and benefits that are different between the alternatives are relevant. Examples of costs that differ between the two alternatives are the cost of the food required to make the meal at home, the cost of the restaurant meal, and the cost of gas or parking necessary to go out to eat. If she decides to make the meal, she must purchase groceries. If she chooses to go out to eat, she does not need to buy the groceries to make the meal. This cost differs between the alternatives, so it is relevant to this decision. In other words, Kendra can avoid the cost of purchasing groceries if she decides to go out to dinner. Therefore, it is an avoidable cost. Avoidable costs are always relevant.

Sunk costs are not relevant to a decision. Sunk costs are costs that have already been incurred and, therefore, cannot be avoided. For example, assume that Kendra owns her automobile. The original cost of purchasing the automobile is considered a sunk cost when considering the cost of driving to the restaurant. Any additional cost to operate the car, such as gas, would be relevant if she incurs the cost to drive to the restaurant but does not incur the cost to eat at home.

Analyzing fixed costs for relevancy

Fixed costs are typically considered in differential decision making involving segments within an organization such as individual products, product lines, geographic locations, or departments. Fixed costs can be challenging to analyze since some fixed costs are generated by a particular segment, and some fixed costs are shared by multiple segments. Therefore, fixed costs are divided into two categories, traceable fixed costs and common fixed costs. Traceable and common fixed costs are discussed in detail in Chapter 5, Segment Income Reporting.

Traceable fixed costs are costs that can be traced directly to an organizational segment. Typically, traceable fixed costs can be avoided if the segment is eliminated. Traceable fixed costs that can be avoided are relevant to the decision.

Common fixed costs are fixed costs that are common to or shared by more than one organizational segment. Managers must analyze common fixed costs to determine if any portion of the cost can be eliminated under any of the potential alternatives. Common fixed costs are not relevant to a decision if they are not eliminated under any of the alternatives. Common fixed costs that cannot be eliminated are unavoidable. On the other hand, common fixed costs are relevant to a decision if they can be eliminated or avoided.

For example, assume that a small drug store has two departments—prescription medications and over-the-counter medications. Both departments are housed in the same building. The cost of rent for the building is considered a common fixed cost since both departments exist in the same building. The cost for rent would not be eliminated if one of the departments is eliminated. Since the cost of rent is unavoidable regardless of what segments are housed within the building, it is not considered relevant to a decision about one of the segments.

Check your understanding LO2

Add or drop a segment LO3

Managers can use differential decision making tools to inform decisions about adding or dropping a segment within an organization. Examples of business segments include product lines, geographic locations, or departments. Organizations must evaluate the products and services they offer and determine the product mix or segment structure that best meets their objectives. Differential decision analysis, based on analyzing relevant costs, can be used to quantify the effects of changing the segment structure, such as adding or dropping a segment. Of course, both quantitative and qualitative factors must be considered for any decision.

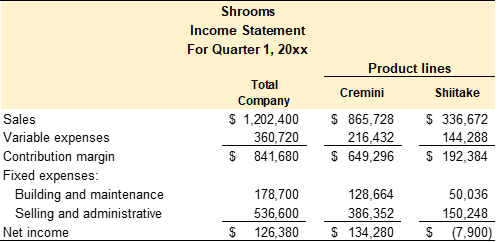

The example of Shrooms, an organic mushroom farm, is used to illustrate the differential decision making tools presented in this chapter. Shrooms grows organic mushrooms for the restaurant industry. Shrooms is a mid-sized, business-to-business supplier in the restaurant industry known for providing high-quality mushrooms at a reasonable cost. Shrooms offers two product lines, cremini mushrooms and shiitake mushrooms. Carlos, the owner of Shrooms, is concerned because the shiitake product line is losing money. The sales price for shiitake mushrooms is four times higher than cremini, so there is less demand. The cost incurred to grow both types of mushrooms is roughly equivalent. He grows and sells 500,000 pounds of cremini and 48,000 pounds of shiitake. He is considering dropping the shiitake product line. The segmented income statement for Shrooms is provided in Exhibit 10-1.

Exhibit 10-1 Segmented Income Statement for Shrooms

At first glance, it might appear that Shrooms’ net income would increase by $7,900 if the shiitake product line were dropped since this is the amount of net loss currently allocated to the shiitake product line. This conclusion would be in error. It does not consider that some the costs allocated to the shiitake product line may not be relevant to this decision. For example, the fixed costs allocated to the shiitake product line may not be eliminated if the product line is eliminated. As mentioned in the section above, costs must be analyzed to determine whether they are relevant or avoidable. Carlos collected additional data, presented below, about the decision to drop the shiitake product line.

- All revenue and variable expenses are traceable to the product lines and would be eliminated if the product line is eliminated.

- Fixed overhead is allocated to the product lines based on sales dollars. Cremini represents 72%, and shiitake represents 28% of total sales dollars. Accordingly, fixed expenses are allocated 72% and 28% to cremini and shiitake, respectively.

- Since the shiitake product line is small compared to the cremini line, none of the employees would be terminated if the shiitake product line is dropped. Also, none of the fixed overhead associated with buildings and maintenance would be reduced.

- The majority of selling and administrative expenses are incurred to sustain the organization. They are common expenses that would continue if the shiitake product line is dropped. However, Carlos determined that $15,025 of the selling and administration expenses are traceable to the shiitake product line. These expenses will be eliminated if the product line is dropped.

- If the shiitake product line is dropped, Carlos could grow and sell an additional 45,000 lbs. of cremini mushrooms, currently selling for $1.70 per pound. Additional sales revenue would be 45,000 x $1.70 = $76,500. The contribution margin ratio for the cremini mushroom product line is 40%. The company would earn 76,500 x 40% = $30,600 in additional contribution margin for the cremini product line.

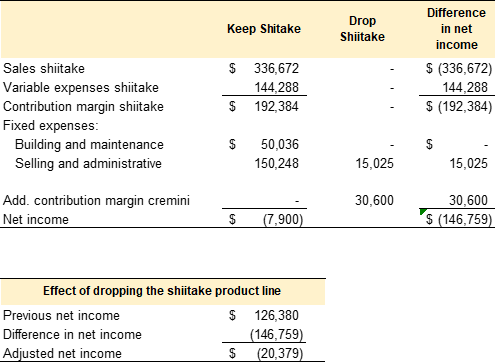

The differential decision analysis for dropping a segment involves determining the effect that dropping the segment would have on net income by analyzing relevant revenue and cost data. Only relevant (avoidable) costs and revenues are considered. The analysis for dropping the shiitake product line is provided in Exhibit 10-2.

Exhibit 10-2 Differential analysis to drop shiitake segment

Refer to Exhibit 10-2. Since sales, variable expenses, and contribution margin are traceable to the product lines, these would be eliminated if the shiitake product line is dropped. Accordingly, the net effect would be a $(192,384) reduction in the overall contribution margin. Loss of contribution margin has a negative impact on net income.

None of the fixed expenses associated with buildings and maintenance would be reduced, so these costs are irrelevant. They are common fixed costs that will need to be absorbed by the cremini product line. Since these costs are not relevant or unavoidable, the difference in net income would be $0.

Per the data, $15,025 of the selling and administration expenses are traceable to the shiitake product line. These expenses will be eliminated if the product line is dropped. Shrooms would save $15,025 in fixed selling and administration expenses. Cost savings have a positive effect on net income. This means that the cremini product line would need to absorb the remaining $135,223 ($150,248 – 15,025) of fixed selling and administrative expenses currently allocated to the shiitake product line.

If the shiitake product line is dropped, Shrooms can grow and sell an additional 45,000 lbs. of cremini mushrooms. Shrooms will earn $30,600 in additional contribution margin for the cremini product line. Additional contribution margin has a positive effect on net income.

The overall effect of dropping the shiitake product line would be a $(146,759) decrease in net income. Shrooms’ overall net income is given in Exhibit 10-1 as $126,380. As demonstrated in Exhibit 10-2, Shrooms will go from $126,380 in net income to $(20,379) in net loss if the shiitake product line is dropped.

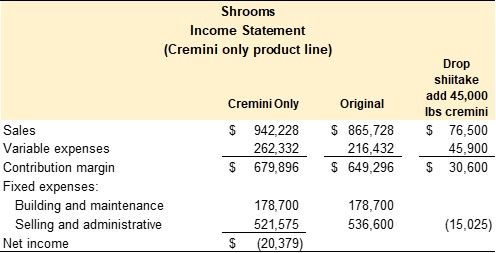

Shrooms’ Income Statement without the shiitake product line is provided in Exhibit 10-3.

Exhibit 10-3 Shrooms’ Income Statement without the shiitake product line

This example illustrates the importance of using relevant revenue and cost data to make managerial decisions. In this case, the shiitake product line only appears unprofitable because of the way in which fixed costs are allocated to the product lines. The shiitake product line is a premium product line that earns a significant contribution margin. In this case, Carlos might consider reallocating the common fixed costs based on pounds of mushrooms produced instead of total sales dollars. Reallocating common fixed expenses based on pounds instead of percentage of sales dollars might produce segmented income statements that better reflect the profitability of the two product lines.

Video Illustration 10-1: Add or drop a segment LO3

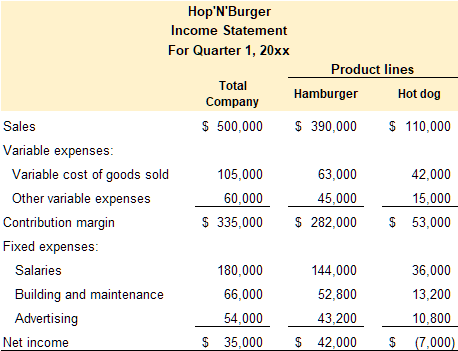

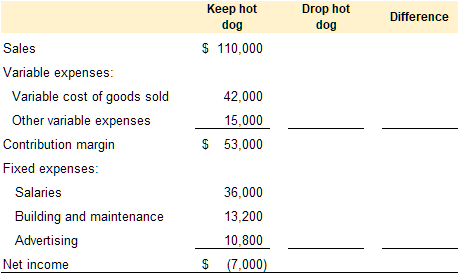

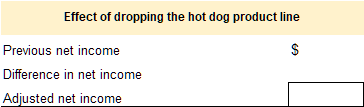

Hop’N’Burger is a local drive-thru restaurant that offers hamburgers and hot dogs. They have two product lines, hamburgers and hot dogs. According to the segmented income statement provided below, the hot dog product line lost $(7,000) in the previous quarter. The manager is considering dropping the hot dog product line to focus on hamburgers. The manager collected the additional information presented below to aid in making this decision.

Exhibit 10-4 Financial data for Hop’N’Buger

Additional information:

1.) The revenue and all of the variable expenses are traceable to the product lines. They would be eliminated if the product line was dropped.

2.) Salary expense is for the store manager and the hourly employees. None of the employees would be terminated if the hot dog product line was dropped.

3.) Building and maintenance represent the expenses related to the restaurant property including rent, insurance, and deprecation. None of these costs would be eliminated if the hot dog product line was dropped.

4.) The majority of advertising expense is general and represents both product lines. However, $5,000 of the advertising budget is spent to advertise the hot dog product line. This advertising would be eliminated if the hot dog product line was dropped.

Prepare a differential analysis to determine if the hot dog product line should be dropped.

Exhibit 10-5 Differential analysis template for Hop’N’Buger, video explanation, and check figures

Check figures:

Check your understanding LO3

Make or buy (outsourcing) LO4

An organization can make a product or perform a function internally, or the organization can purchase the product or service from an external supplier. Evaluating this decision is traditionally known as a make or buy analysis. Make or buy decisions are considered differential decisions since only relevant costs and benefits are considered. While it is referred to as a make or buy decision, it is also used to analyze performing an activity internally versus outsourcing the activity to an outside supplier. For example, managers can use this tool to compare the costs of making a physical product versus buying the product from an external supplier. Managers can also compare the costs of performing an activity internally, such as payroll or customer service, versus outsourcing the activity to an external company.

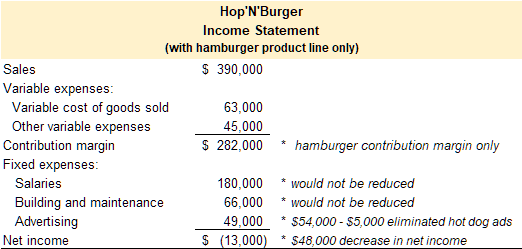

The example of Shrooms, an organic mushroom farm, is continued to illustrate a make or buy decision. Currently, Shrooms is purchasing organic compost from an outside supplier. Carlos recently attended a workshop on making organic compost. He wants to determine if it is more profitable to buy the compost from an external supplier or make it on the farm. Carlos uses 7,200 cubic feet of compost each year. He purchases the compost from an outside supplier for $18 per cubic foot. Carlos collected the data, presented below, related to the cost of making the compost on the farm.

- Carlos has an unused area on the farm that can be used to make the compost. He already owns the farming equipment and other tools required to make the compost. The farm’s overhead, e.g., equipment, buildings, utilities, supplies, etc., is applied to the existing product lines–cremini and shiitake–based on pounds harvested. The current overhead rate is $0.30 per pound. Carlos would not incur additional farming overhead costs if he decides to make the compost.

- The farm supervisor would be in charge of making the compost. The supervisor is paid a yearly salary of $50,000, approximately $24 per hour. The supervisor has enough time to assume the extra responsibility during regular working hours. The supervisor would not be paid for additional hours or overtime to make the compost.

- Making 7,200 cubic feet of compost requires 9,000 cubic feet of untreated wood chips that cost $10.50 per cubic foot.

- Carlos estimates that indirect materials, e.g., nitrogen-rich green materials, will cost an additional $2,100 per year.

The differential decision analysis for making or buying the compost involves analyzing relevant cost data and determining the most cost-effective alternative. Only relevant (avoidable) costs and benefits are considered. Carlos has the space, equipment, and employee labor hours to make the compost. Therefore, making the compost on the farm would not increase the farm’s overhead or direct labor costs. Since these costs are the same whether he makes the compost or purchases it from an outsider supplier, they are irrelevant to this decision. The relevant costs are the untreated wood chips and indirect materials required to make the compost. The cost of purchasing the compost from an outside supplier is also relevant since it can be avoided if Carlos decides to make the compost. An analysis for making the compost versus buying it is provided in Exhibit 10-6. The cost savings for making the compost is projected to be $33,000 per year.

Exhibit 10-6 Differential analysis make or buy compost

Video Illustration 10-2: Make or buy (outsourcing) decision LO4

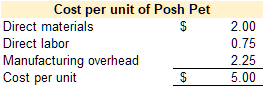

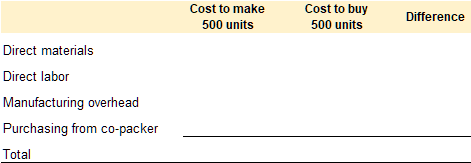

Jada developed an all-natural, human-grade dog food called Posh Pet. She is currently making the dog food in a small rented space. She was approached by a local co-packer. The co-packer offered to make Posh Pet for $3.30 per unit. She currently sells 500 units per month. She collected the following information to aid in making this decision. Should she sign a contract to purchase Posh Pet from the co-packer?

Exhibit 10-7 Cost per unit of Posh Pet

Additional information:

1.) Direct materials would be provided by the co-packer

2.) Jada has one employee that makes the dog food. If she outsources to a co-packer this employee would be terminated.

3.) All of the manufacturing overhead would be eliminated except the rent on the facility. Jada signed a two year lease on the space. If she outsources to a co-packer the space currently used to make the product would be converted to office space. She doesn’t need the additional space and cannot use it for any other purpose. Of the monthly lease amount, $1,000 per month is allocated to producing the product. The lease represents $2.00 ($1,000/500 units) of the current overhead charge.

Exhibit 10-8 Differential analysis template for Posh Pet and video explanation

Check your understanding LO4

Special order LO5

A special order is a one-time order not connected to an organization’s normal sales cycle. Special orders are generally not included in the organization’s budgeted sales projections. Special orders arise outside of projected sales activities. For example, assume that an organization makes a product and sells it directly to retail customers. Further, that the organization receives a request to donate or provide its product at a discounted rate for a local fundraising event. This situation is considered a special order.

On the other hand, selling a product to a non-profit would not be a special order if the product is sold through normal sales channels. For example, assume that an organization prints promotional items for organizations, non-profits, and events. One of their customers is a non-profit organization. The non-profit customer purchases promotional items for a fundraiser on the organization’s website. This example is considered normal business operations and not a special order.

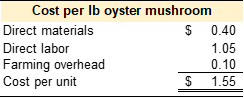

Differential decision making can be used to analyze the effects of accepting a special order. The example of Shrooms, an organic mushroom farm, is continued to illustrate a special order decision. A local farmer’s market organizer contacted Carlos and asked him to participate in a fundraising event promoting healthy, local, sustainable foods. The organizer plans to sell promotional meal kits with all the ingredients to make a healthy meal at home. The organizer asked Carlos if he would grow a special batch of oyster mushrooms for the meal kits. They requested 250 pounds of oyster mushrooms for $1.50 per pound. Carlos is interested in participating in the fundraiser if the special order price of $1.50 per pound covers his cost to grow the mushrooms. Carlos collected the data, presented below, about the cost of growing the special order oyster mushrooms.

- A nominal amount of farm space is required to grow 250 lbs. of oyster mushrooms. Carlos has an unused area on the farm that can be used to grow the oyster mushrooms. He owns the farming equipment and other tools required to produce the mushrooms. The farm’s overhead, e.g., equipment, buildings, utilities, supplies, etc., is applied to the existing product lines–cremini and shiitake–based on pounds harvested. The current overhead rate is $0.30 per pound. Two-thirds ($0.20) of the farm overhead rate is fixed overhead and one-third ($0.10) is variable overhead. The special order would not increase fixed overhead. However, $0.10 of variable overhead would be incurred on each pound of oyster mushrooms grown.

- Carlos would have to pay contracted labor to harvest the mushrooms. Farm labor is paid per pound harvested. The current labor rate is $1.05 per pound.

- Direct materials include seeds, compost, water, and packaging. Direct materials are estimated to be $0.40 per pound.

Differential decision analysis can be used to determine the financial effect of accepting the special order. Only relevant (avoidable) costs and benefits are considered. The differential analysis for the fundraiser special order is provided in Exhibit 10-9. Direct material ($0.40), direct labor ($1.05), and variable farm overhead ($0.10) are relevant costs. The fixed farm overhead ($0.20) is irrelevant since the special order would not change the farm’s fixed overhead costs. The oyster mushrooms would cost Carlos $1.55 per pound to produce. The event organizer asked Carlos to provide 250 pounds for $1.50 per pound. Carlos would incur a $12.50 loss on the special order, 250 lbs. x ($1.50 special order sells price – $1.55 special order cost of goods sold) = $12.50. Carlos could turn down the special order request, accept the loss, or ask the event organizer to pay $1.55 per pound to cover his costs.

Exhibit 10-9 Differential analysis fundraiser special order

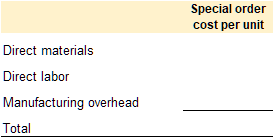

Video Illustration 10-3: Special order decision LO5

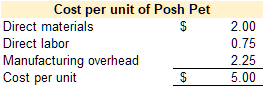

Jada developed an all-natural, human-grade dog food called Posh Pet. She is currently making the dog food in a small rented space. Due to local wildfires, a local shelter asked if she could provide her dog food at cost to help with the influx of displaced animals. She currently sells 500 units per month and this request would not affect her normal sales. She wants to help the shelter and just cover the incremental costs associated with the special order. She collected the following information to aid in making this decision. What is the per unit amount she needs to charge to cover her costs?

Exhibit 10-2 Financial data for Posh Pet

Additional information:

1.) All of the additional units would require direct material and direct labor.

2.) Of the manufacturing overhead, $2.00 per unit is a fixed charge for rent on the facility. She has the space to make the order so the special order would have no effect on the rent. The remaining $0.25 of manufacturing overhead is variable and would be incurred on each unit in the special order.

Exhibit 10-2 Differential analysis template for Posh Pet and video explanation

Check your understanding LO5

Sell or process further LO6

Some raw materials must be separated or refined in the process of manufacturing a final product. Secondary materials or by-products are sometimes created when the original raw material is separated or refined. A single raw material input that can be separated into one or more materials is known as a joint product. The point at which the original raw material input is separated into more than one output is known as the split-off point. For example, crude oil is considered a joint product. Several oil products, including gasoline, jet fuel, lubricants, petroleum jelly, and other chemicals, are extracted during the refinement process. Differential decision making can be used to analyze the effect of selling the by-products created at the split-off point versus processing the by-products further before selling them.

Costs are classified as joint costs or additional processing costs when considering a sell or process further decision. Joint costs are costs incurred to process the raw material input to the split-off point. Secondary materials or by-products are created at the split-off point. The costs incurred to process the secondary materials after the split-off point are additional processing costs.

Joint costs are irrelevant when deciding to sell or process by-products further. Joint costs are considered sunk costs. Regardless if the by-product is discarded, sold as is, or processed further, the joint costs have already been incurred and are therefore unavoidable.

Additional processing costs are relevant to the decision to sell or process further because they are different between the alternatives. If the by-product is discarded or sold as is, additional processing costs are not incurred. However, additional processing costs are incurred if the by-product is processed further.

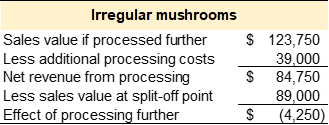

Differential decision making can be used to analyze the decision to sell a by-product as is or to process it further. The example of Shrooms, an organic mushroom farm, is continued to illustrate a sell or process further decision. Carlos projects that he can produce 500,000 lbs. of cremini and 48,000 lbs. of shiitake mushrooms in the upcoming fiscal year. Approximately 10% of both species of mushrooms will not comply with commercial standards in terms of caliber, shape, or size. At harvest, Carlos projects that 50,000 lbs. of cremini and 4,800 lbs. of shiitake mushrooms will be irregular mushrooms. Irregular mushrooms cannot be sold through the company’s regular sales channels. Carlos can sell the irregular mushrooms, as is, to a food co-packer that uses the mushrooms in a commercial soup product. Or, Carlos can process the irregular mushrooms into an organic dried blend and sell them to a vendor at the farmer’s market. Carlos collected the data, presented below, related to this decision to sell the irregular mushrooms as is or process them into a dried mushroom blend.

- The retail prices for mushrooms that comply with commercial standards are $1.92 per pound of cremini and $7.20 per pound of shiitake.

- Both products have similar costs to grow, $1.75 per pound. Product growing costs include direct materials $0.40, direct labor $1.05, and farm overhead $0.30.

- The copacker will pay $1.30 and $5.00 per pound for the irregular cremini and shiitake mushrooms, respectively.

- Carlos can sell the organic dried blend mushrooms for $4.50 per half-pound bag.

- The irregular mushrooms could be combined, dehydrated, and packaged to process the mushrooms into a dried mushroom blend. One pound of fresh mushrooms yields one-half pound of dried mushrooms. The total of dried blend would be (50,000 + 4,800 lbs.) / 2 = 27,400 pounds. Carlos estimates it will cost an additional $6,000 to dehydrate the dried blend. The dried blend would be packaged in half-pound bags. Packaging costs for the dried blend are $1.20 per bag.

The retail prices for the commercially standard mushrooms are irrelevant since the irregular mushrooms cannot be sold through normal sales channels.

The product costs incurred to grow the mushrooms are considered joint costs. These costs are incurred to produce all the mushrooms. The irregular mushrooms are a by-product of the commercially standard mushroom harvest. The harvest is considered the split-off point.

The irregular mushrooms can be sold, as is, to the food copacker. This amount is relevant since this revenue is only realized if Shrooms sells the mushrooms to the copacker at harvest. The total sales value of the irregular mushrooms at the split-off point is (50,000 x $1.30) + (4,800 x $5.00) = $89,000.

The dried mushroom blend sales price is relevant since this revenue is only realized if Carlos processes the irregular mushrooms into the dried blend. Carlos can produce 27,400 half-pound bags of the organic dried blend. The total sales value of the organic dried blend is 27,400 bags x $4.50 = $123,750.

The cost of processing the irregular mushrooms into the organic dried blend is also relevant. Total additional processing costs are $6,000 + (27,500 bags x $1.20) = $39,000.

The differential analysis for the decision to sell or process the irregular mushrooms is provided in Exhibit 10-10. Shrooms would lose $4,250 in revenue by processing the mushrooms into the dried blend. The most profitable alternative is to sell the unprocessed mushrooms to the copacker.

Exhibit 10-10 Differential analysis sell or process irregular mushrooms

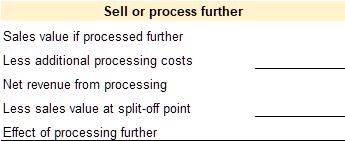

Video Illustration 10-4: Sell or process further decision LO6

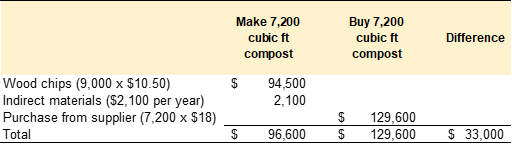

CheezeChef is a local cheese manufacturer that specializes in small-batch, artisanal cheeses. During the cheese making process whole milk is separated into curds and whey. Curds are the solids that are used to make the most cheeses. Whey is the liquid left after the solids are removed. Whey is rich in nutrients. The milk costs $2.40 per gallon. It costs CheezeChef $0.90 to separate the curds and whey.

CheezeChef is considering processing the whey into ricotta cheese or selling it to a local company that extracts protein from the whey. The local company offered to pay $2.60 per gallon of whey. Or, CheezeChef can process one gallon of whey to make one pound of ricotta cheese. It would cost $1.80 to process the whey into ricotta. They could sell the ricotta for $4 per pound. Should CheezeChef sell the whey at the split-off point or process it further into ricotta cheese?

Joint costs (not relevant)

Exhibit 10-2 Differential analysis template for CheezeChef and video explanation

Check your understanding LO6

Practice Video Problems

The chapter concepts are applied to comprehensive business scenarios in the below Practice Video Problems.

Practice Video Problem 10-1: Add or drop a segment LO3

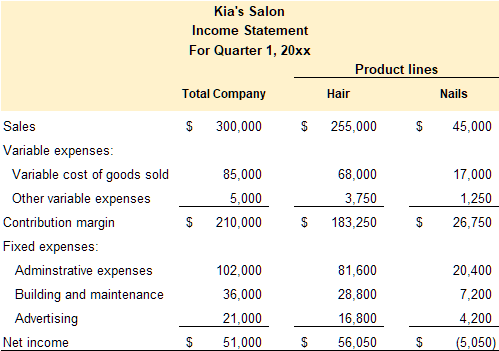

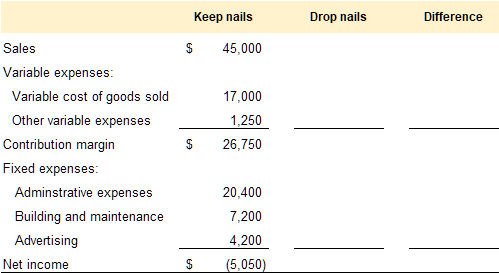

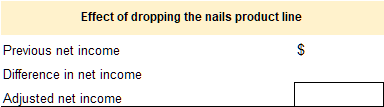

Kia’s Salon offers two services, hair styling and nails. According to the segmented income statement presented below, the nails product line lost $(5,050) in the previous quarter. The manager is considering dropping the nails product line to focus on hair styling. The manager collected the additional information presented below to aid in making this decision.

Additional information:

1.) The revenue and all of the variable expenses are traceable to the product lines. They would be eliminated if the product line was dropped.

2.) Administrative expenses include salaries and general administrative expenses. Of the $20,400 allocated to the nails product line, $18,000 represents the salary for the nail technician and scheduler. Her position would be eliminated if the nails product line is dropped. The remaining expenses are general expenses and would not be eliminated.

3.) Building and maintenance represent the expenses related to the salon property including rent, insurance, and deprecation. None of these costs would be eliminated if the nails product line was dropped.

4.) The entire $4,200 of the advertising budget is spent to advertise the nails product line. This advertising would be eliminated if the nails product line was dropped.

Required: Prepare a differential decision making analysis to determine if the nails product line should be dropped.

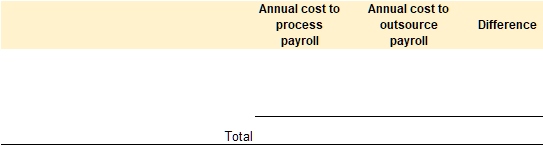

Practice Video Problem 10-2: Make or buy (outsourcing) decision LO4

Ali’s Grooming currently processes the company’s payroll in house. She received a quote from a local CPA firm to process her payroll for $75 per week. Currently, Ali’s bookkeeper enters the data into a payroll module within the company’s accounting software. It costs an extra $2,500 per year to purchase the payroll module with the accounting software package. The accounting software creates the paychecks as well as the related entries for payroll taxes and benefits. The bookkeeper spends about 4 hours per week processing payroll and handling payroll related tasks. The bookkeeper makes $20 per hour. The bookkeeper would still work her normal 40 hours per week even if the payroll function was outsourced. The bookkeeper currently does not have enough work to require overtime hours.

Required: Prepare a differential decision making analysis to determine if the payroll function should be outsourced.

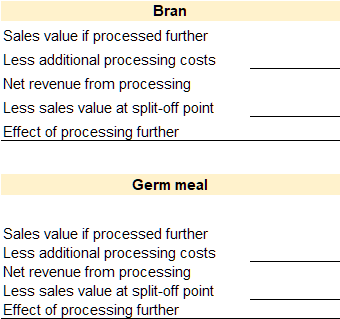

Practice Video Problem 10-3: Sell or process further decision LO6

Healthy Farms operates a small family farm that specializes in growing organic, non-GMO produce. Their largest product in terms of revenue is wheat flour. It costs approximately $2.70 to grow one bushel of wheat. The wheat is milled on the farm to create flour. It costs $0.90 per bushel to mill the wheat and produce wheat flour.

Two by-products of the milling process are bran and germ meal. Each year they generate approximately 4,000 pounds of bran and 8,000 pounds of germ meal. Healthy Farms can sell the bran and germ meal as is to a local farmer for livestock feed and get $2 per pound. Or, Healthy farms can process the bran into a fiber supplement that sells for $3.00 per pound for an additional $4,200 in processing and packaging costs. And they can process the germ meal into a health food supplement that sells for $2.75 per pound for an additional $4,700 in processing and packaging costs.

Required: Prepare a differential decision making analysis to determine if the bran and germ meal should be sold as is or processed further.

Review Questions

Review questions reinforce the chapter content.

Homework Questions

Homework questions can be used for additional practice or can be assigned in an academic setting. Full feedback is not available online. Homework questions can be assigned, with auto-grading and export, to specific learning management platforms, e.g., Canvas, Blackboard, etc. Contact the author for details.