9 Decentralized Performance Evaluation

Learning Objectives LO

LO1 Describe the advantages and disadvantages of a decentralized organizational structure

LO2 Describe responsibility centers and their performance evaluation

LO3 Evaluate the performance of investment centers using profit margin ratio, asset turnover ratio, and return on investment ratio

LO4 Describe the advantages and disadvantages of return on investment (ROI)

LO5 Describe social return on investment (SROI)

LO6 Compute residual income and identify its strengths and weaknesses

Organizational structure LO1

Organizational structure is defined as the manner in which authority, responsibility, and lines of communication are arranged within an organization. Organizational structure is typically considered more centralized or decentralized.

In a centralized organization, authority and responsibility are concentrated in the highest levels of management. The rest of the organization is responsible for following orders. A small, family-owned business is more likely to have a centralized structure where the owners make most of the business decisions. Smaller organizations with fewer managerial employees usually have a more centralized organizational structure.

In a decentralized organization, lower levels of management have the authority to make decisions and also hold some degree of responsibility for their decisions. Examples of decentralized organizations are fast-food or retail store chains such as Chipotle or Walmart. In most chain stores, store managers have the authority to make decisions regarding the daily operations of their store or location. However, some decisions are made at the corporate level and pushed down to the store managers.

Very few organizations are considered entirely centralized or decentralized. Instead, most organizations fall somewhere on the centralized spectrum. Except in very small organizations, some authority and responsibility must be delegated to lower-level employees. For example, decision-making authority is more centralized in the military, but many decisions are delegated to military branches, commands, formations, and units.

The major advantages and disadvantages of decentralization are discussed in the next section. Then the types of responsibility centers found in a decentralized organization are defined. Performance evaluation is an essential component of the operational cycle when authority and responsibility are delegated to responsibility centers. The accounting tools used for performance evaluation depend on the type of responsibility center being evaluated. In the remaining sections of this chapter, tools used for the performance evaluation of investment centers are presented.

Advantages of decentralization

- Higher management can focus on more significant organizational issues if routine business decisions are delegated to lower-level management.

- Lower-level employees are more involved in day-to-day operations and usually have more information about routine business than higher-level employees.

- Organizations can respond to issues more quickly when authority is delegated.

- Lower-level employees feel more empowered, which can lead to increased job satisfaction.

Disadvantages of decentralization

- Lower-level employees may make decisions without fully understanding the impact on the larger organization.

- The motivation of an employee may conflict with the objectives of the overall organization. For example, an employee might be concerned with getting resources for a particular department or for personal promotion. When authority is delegated to more employees the potential for personal conflict increases.

Check your understanding LO1

Responsibility centers and performance evaluation LO2

Responsibility centers are individual segments within an organization to which authority and responsibility have been delegated. There are four main types of responsibility centers—revenue centers, cost centers, profit centers, and investment centers.

Revenue centers

A revenue center is an organizational unit solely responsible for generating revenue for the organization. Managers of revenue centers usually have authority and responsibility over revenues or sales but little authority over costs, profits, or purchasing long-term, capital assets. The sales staff in a telemarketing organization is an example of a revenue center. Actual revenues or sale data are used to evaluate performance in a revenue center. Costs and investments in assets are not evaluated at this level. Performance evaluation for revenue centers typically involves comparing the actual revenue generated with revenue projections. Flexible budgeting is commonly used for performance evaluation in revenue centers. Flexible budgeting is presented in chapter 7 of this textbook.

Cost centers

A cost center is an organizational unit that incurs costs but is not responsible for generating revenue or profit. Managers of cost centers usually have authority and responsibility for the costs associated with operating a particular segment within the organization. Managers of cost centers typically don’t have responsibility for revenues, profits, or purchasing long-term, capital assets. Administrative departments within an organization, such as marketing, accounting, or human resources, are examples of a cost centers. While these departments don’t usually generate sales, they are responsible for the costs associated with daily departmental operations. In a cost center, the actual costs incurred are evaluated whereas revenue and investments in assets are not considered at this level. Performance evaluation for cost centers typically involves comparing the actual costs incurred with cost projections. Flexible budgeting and standard cost variance analysis, presented in chapters 7 and 8 respectively, are two examples of tools used for performance evaluation in cost centers.

Profit centers

A profit center is an organizational unit responsible for generating profits for the organization. Profit is calculated as sales or revenues less the costs, also known as expenses, associated with generating the revenue. Managers of profit centers have responsibility for both revenues and costs. Managers of profit centers do not have responsibility for purchasing or investing in long-term, capital assets. Performance evaluation for profit centers typically involves comparing actual profits to projected profits. As with cost and revenue centers, flexible budgeting presented in chapter 7, is commonly used for performance evaluation in profit centers.

Investment centers

The entire organization is considered an investment center. The organization may also have smaller investment centers embedded within the overall structure, such as product lines or geographic locations. Managers of investment centers usually have authority and responsibility for the revenues, costs, and investments in assets associated with the overall organization or a particular segment within the organization. The remainder of this chapter focuses on performance evaluation for investment centers.

Check your understanding LO2

Investment centers and performance evaluation LO3

Investment centers are responsible for generating revenues, controlling costs, and earning a profit on the organization’s investment in operating assets. Operating assets are assets that are used during the normal course of business operations, such as buildings, equipment, furniture, vehicles, or technology. Non-operating assets are assets that are not used during the normal course of business operations and are commonly considered investment assets. Examples of non-operating assets include investments in other companies or undeveloped land purchased for future use.

The goals of performance evaluation for investment centers are to analyze a manager’s ability to generate revenue, control costs, and maximize profitability on the organization’s investment in operating assets. This section discusses four tools commonly used to evaluate the performance of investment centers: profit margin ratio, asset turnover ratio, return on investment ratio, and residual income. The example of Digital Designs is used to illustrate these tools.

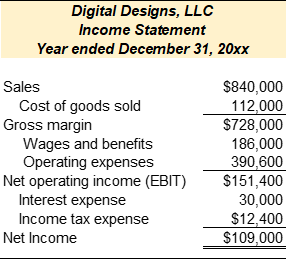

Digital Designs, LLC creates custom digital technologies and advertising solutions for businesses operating in the online space, including websites, online storefronts, digital advertising campaigns, and social media assets. Dalia, the CEO, is evaluating the organization’s overall performance. The Income Statement and select data from the company’s Balance Sheet are provided in Exhibit 9-1 below.

Exhibit 9-1 Financial data for Digital Designs, LLC

Profit margin ratio

The profit margin ratio is a measure of profitability. This ratio calculates net operating income as a percentage of sales. Net operating income is typically used for this ratio, which is net income before interest expense and taxes, also commonly referred to as earnings before interest and taxes, or EBIT for short. This ratio measures a manager’s ability to generate sales, control costs, and generate profits. The formula to calculate the profit margin ratio is provided in Exhibit 9-2.

Exhibit 9-2 Profit margin ratio

![]()

Refer to the Digital Designs data in Exhibit 9-1. Net operating income and sales are reported on the Income Statement. The terms income and profit can be used interchangeably in this context. Net operating income represents the net profit earned from business operations before interest expense and income tax expense are deducted. Net operating income is commonly referred to as earnings before interest and taxes or EBIT. Profit margin is expressed as a percentage. Digital Design’s profit margin is calculated as $151,400 / 840,000 = 18% (rounded). Digital Designs returns 18% in net operating profit for every dollar of sales.

Managers should focus on increasing revenues while decreasing costs to improve this ratio. The profit margin ratio is sufficient to evaluate profitability, which is a manager’s ability to generate revenues and control costs. However, this ratio does not examine revenues or net operating income in relation to the organization’s investment operating assets. Therefore, the asset turnover ratio is used to a manager’s ability to generate revenues using the organization’s operating assets.

Asset turnover ratio

The asset turnover ratio is considered a measure of efficiency. This ratio measures how efficiently an organization is using its operating assets to generate sales. The ratio calculates sales as a percentage of average operating assets. Operating assets are defined as the assets used during the ordinary course of business operations but not those assets held for long-term investment or future use. This ratio uses an average of operating assets. For financial ratio analysis, averages are used to smooth out fluctuations caused by periodic changes in certain asset and equity accounts. For example, purchasing a large amount of inventory or new equipment just before the end-of-year financial data are reported could cause a temporary inflation in operating assets. Averages used for financial ratio analysis typically include two years or periods, the prior and current periods. The formula to calculate the asset turnover ratio is provided in Exhibit 9-3.

Exhibit 9-3 Asset turnover ratio

![]()

Refer to the Digital Designs data in Exhibit 9-1 above. Sales are reported on the Income Statement, and assets are reported on the Balance Sheet. Sales are $840,000. The investment in Media Minds, Inc. is considered a non-operating asset, so total assets are not used for this calculation. Data for operating assets from the beginning and end of the year, $1,216,000 and $1,177,600, respectively, are used to compute average operating assets. Average operating assets are ($1,216,000 + 1,177,600) / 2 = $1,196,800. Asset turnover is commonly expressed as a multiple of times. Digital Design’s asset turnover is calculated as $840,000 / 1,196,800 = 0.702 (rounded) times. On every dollar invested in operating assets, Digital Designs returns 0.702 times that in sales dollars.

The asset turnover ratio measures how efficiently managers purchase the operating assets used by an organization. A business organization is a collection of assets and people. The selection of assets an organization can purchase is unlimited, so evaluating how efficiently managers make purchasing decisions is critical. The goal is to maximize spending on assets that generate revenues and minimize spending on non-essential assets that don’t generate revenues.

To improve this ratio, managers should focus on increasing sales revenue and minimizing spending on non-essential assets that don’t generate revenues. While the asset turnover ratio is sufficient to evaluate how efficiently an organization can use its operating assets to generate sales revenue, it does not consider a manager’s ability to control costs and generate profits.

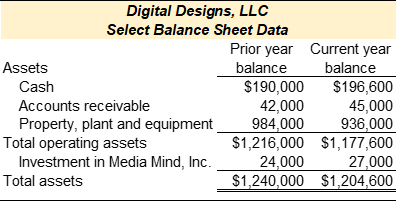

Return on investment (ROI) ratio

The return on investment (ROI) ratio is a measure of both profitability and efficiency. This ratio measures how efficiently an organization can use its operating assets to generate net profit or net operating income. It calculates net operating income as a percentage of average operating assets. Because of its simplicity and versatility, ROI is a widely used performance measure for entire organizations, investment centers within organizations, and specific projects or investments. The formula to calculate the ROI ratio is provided in Exhibit 9-4.

Exhibit 9-4 Return on investment ratio

![]()

Refer to the Digital Designs data in Exhibit 9-1. Net operating income is reported on the Income Statement, and assets are reported on the Balance Sheet. Net operating income is $151,400. To compute average operating assets data from the beginning and end of the year are given, $1,216,000 and $1,177,600, respectively. The investment in Media Minds, Inc. is considered a non-operating asset, so total assets are not used for this calculation. Average operating assets are ($1,216,000 + 1,177,600) / 2 = $1,196,800. ROI is commonly expressed as a percentage. Digital Design’s ROI is calculated as $151,400 / 1,196,800 = 12.7% (rounded). The company generates a 12.7% return in net operating income or profit for every dollar invested in operating assets.

The ROI ratio measures the return or profitability of an investment relative to its cost. As mentioned above, an organization is a collection of assets and people. At the organizational level, ROI measures the net profit generated by an organization’s operating activities relative to its investment in operating assets. To improve this ratio, managers should focus on increasing sales revenue, decreasing costs, and selecting the optimal mix of operating assets.

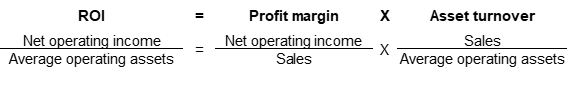

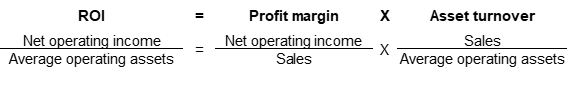

Relationship between ROI, profit margin, and asset turnover ratios

ROI, profit margin, and asset turnover are related. In mathematical terms, ROI equals profit margin times asset turnover as shown in Exhibit 9-5.

Exhibit 9-5 Relationship between ROI, profit margin, and asset turnover ratios

ROI for Digital Designs can be calculated as profit margin 18% x asset turnover 0.702 = ROI 12.636% (slight difference due to rounding). The formula to demonstrate this relationship, is presented in Exhibit 9-6.

Exhibit 9-6 Digital Designs ROI, profit margin, and asset turnover ratios

Using ROI to evaluate investments

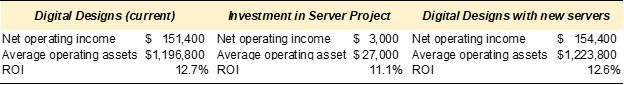

ROI can also be used to evaluate the profitability of investments in specific projects relative to the projects’ cost. To illustrate, assume that Digital Designs is considering purchasing a new rack of servers to store data onsite instead of outsourcing server space. Cost and revenue data for the proposed new server project are provided in Exhibit 9-7.

Exhibit 9-7 Cost and revenue data for new server project

When computing ROI for a specific investment or project, the project’s cost and projected net operating income are used. The new server equipment costs $27,000. The project’s net operating income is projected revenue less expenses or $15,000 – 12,000 = $3,000. ROI for the new server project is $3,000 / 27,000 = 11.1% (rounded).

Video Illustration 9-1: Return on investment (ROI), profit margin, and asset turnover ratios

Ashanti is the founder of a successful multi-state retail chain that specializes in office and home décor. She reported the following results for last month.

Compute her profit margin, asset turnover, and return on investment (ROI) ratios.

Exhibit 9-8 Computing ROI, profit margin, and asset turnover ratios and video explanation

Check your understanding LO3

Advantages and disadvantages of return on investment (ROI) LO4

The return on investment (ROI) ratio is widely used for performance evaluation in the business and financial sectors because it has significant advantages. Most importantly, ROI is easy to compute, and the required financial data is readily available. ROI measures an organization’s profitability on its assets, encouraging the generation of maximum profits and the optimum use of assets. And ROI is a good measure for comparative analysis. ROI can be used to compare the efficiency and profitability between organizations, individual units within an organization, or specific projects or investments.

ROI also has disadvantages. A significant limitation is that ROI focuses exclusively on current profitability so long-term goals, social responsibility, and environmental benefits are often ignored. Focusing on short-term profits can incentivize some employees to make decisions that have short-term gains but are not beneficial to the organization, employees, or the environment in the long term. For example, managers may cut funds for employee training or product development because these costs are incurred immediately, whereas the benefit may not be realized until a future period. Another limitation is that organizations with a high ROI may reject profitable investments with long-term benefits if accepting the investment lowers the current ROI.

To illustrate, refer to the data in Exhibit 9-9. Assume that Digital Designs requires a minimum new investment ROI of 10%. The current ROI for Digital Designs is 12.7%. The ROI for the new server project is 11.1%, which meets the minimum new investment ROI of 10%. Therefore, the server project could be considered an acceptable investment. However, since the ROI for the new server project is lower than the company’s current ROI, this investment would decrease the company’s ROI to 12.6%. If management is evaluated on ROI, they might reject the server project even though it meets the company’s minimum requirement. If there are potential projects with higher ROIs, the server project might not be the best investment. However, the server project might be unduly rejected if investment possibilities with higher ROIs are unavailable or if the server project has long-term benefits.

Exhibit 9-9 Digital Designs ROI comparison with server project

Video Illustration 9-2: Computing return on investment (ROI) for an organization and a project within the organization and illustrating a disadvantage of ROI

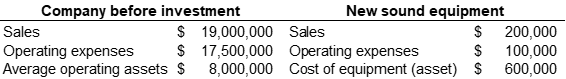

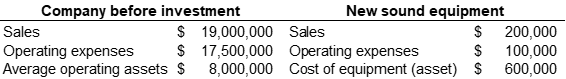

NewAge Sound is a successful audio company. The company requires a minimum new investment ROI of 15%. Financial data for the company’s most recent fiscal year is provided below. The company is considering investing in a new piece of sound equipment that can be used to securely transmit data within a small space. The equipment can be rented by event organizers to verify ticket data at events. Projected financial data for the new equipment is also provided below.

Exhibit 9-9 Computing ROI for multiple scenarios and video explanation

Calculate the return on investment (ROI) for the company before the investment, the potential investment in the new equipment, and the company if the investment in the equipment is made.

ROI–company before investment

ROI–investment in new sound equipment

ROI–company with sound equipment

Check your understanding LO4

Social return on investment (SROI) LO5

Social return on investment (SROI) is a relatively new tool used by organizations to quantify social responsibility and environmental benefits. As mentioned previously, one of the major disadvantages of traditional return on investment (ROI) is that it focuses almost exclusively on short-term profitability. Conventional ROI ignores social responsibility and environmental benefits. Accordingly, many organizations do not consider projects that create or maintain social value when ROI is the only performance measure. SROI is a measure that attempts to quantify social and environmental benefits. Organizations can use SROI to measure the value that their investments create for the community, society, or the environment.

One way to quantify a project’s social return is assigning monetary amounts to social benefits. This process is known as calculating a project’s social impact value. Determining the social impact value is inherently problematic. Organizations and researchers are starting to introduce methodologies to quantify social impact value. Social impact value attempts to quantify the project’s social outputs, outcomes, and impacts. However, placing a quantitative value on outcomes or impacts, such as cleaner water or deforestation reduction, presents challenges for organizations, accountants, and financial analysts. Once the social impact value is assigned, the below ratio can be used to compute SROI.

Exhibit 9-10 Social return on investment ratio

![]()

Video Illustration 9-3: An economic approach to social return on investment

Financial economist Ralph Chami is an assistant director at the International Monetary Fund (IMF) and the cofounder of Blue Green Future and Rebalance Earth. He’s developed a novel way to tackle both climate change and biodiversity loss: namely, to reposition species such as whales and elephants as crucial allies in the quest to sequester carbon, secure climate-resilient ecosystems and generate income for local communities. Chami himself experienced the majesty of whales firsthand in the Sea of Cortez in 2017.

Chami advocates for integrating natural capital into our economy, bringing together investors, conservationists and policymakers. “We’re seeking to build a new economic paradigm that is nature-positive and promises to deliver sustainable and shared prosperity to all,” he says.

Check your understanding LO5

Residual income LO6

Residual income is a tool used to evaluate investment center performance. Residual income is the amount of income earned above a certain required minimum return. Organizations establish their minimum required return by considering inputs such as the cost of capital and desired profitability. The formula to calculate residual income is provided in Exhibit 9-11.

Exhibit 9-11 Residual income formula

![]()

Residual income produces the dollar amount of net income above or below the required minimum return. Providing a dollar amount instead of a percentage is both an advantage and disadvantage of using residual income to evaluate performance. The advantage is that positive residual income indicates that a project produces more than the minimum required return, meaning the project should be considered. The disadvantage of evaluating a dollar amount is that it is difficult to determine the actual return percentage above or below the minimum required return.

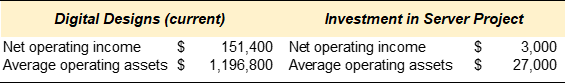

Like ROI, residual income can be used to evaluate the overall organization, segments within the organization, or potential investments. To illustrate, refer to the Digital Designs data provided in Exhibit 9-12. Assume that Digital Designs requires a minimum rate of return of 10%.

Exhibit 9-12 Data for Digital Designs to compute residual income

Residual income for the organization is calculated as $151,400 – (1,196,800 x 10%) = $31,270.

Residual income for the investment in the server project is calculated as $3,000 – (27,000 x 10%) = $300.

Digital Designs is currently earning $31,270 of residual net operating income above the minimum required threshold of 10%. The proposed investment in the new server project would provide $300 of residual net operating income above the minimum required threshold of 10%. Residual income for the organization and the new server project is positive, meaning that both returns on investment exceed the minimum required return. Since the output is a dollar amount, this formula does not provide the exact percentage of return. The return on investment (ROI) ratio can be used to determine the actual return on investment percentage.

If residual income is negative, the net operating income provided by the organization or investment does not meet the minimum required return. Caution should be used when evaluating a negative residual income. A negative amount only shows that the organization or investment is not returning the minimum required return. A negative residual income does not always mean that the organization or investment is not producing any return on investment. For example, a projected investment that returned 9% of operating income on operating assets would result in a negative residual income when a 10% threshold is used.

Video Illustration 9-3: Computing residual income for an organization and a project within the organization

NewAge Sound is a successful audio company. The company requires a minimum ROI of 15% on new investments. Financial data for the company’s most recent fiscal year is provided below. The company is considering investing in a new piece of sound equipment that can be used to securely transmit data within a small space. The equipment can be rented by event organizers to verify ticket data at events. Projected financial data for the new equipment is also provided below.

Exhibit 9-12 Computing residual income for multiple scenarios and video explanation

Calculate the residual income for the company before the investment, the residual income for the investment, and the residual income after the investment

Residual income–company before investment

Residual income–investment in new sound equipment

Residual income–company with sound equipment

Check your understanding LO6

Practice Video Problems

The chapter concepts are applied to comprehensive business scenarios in the below Practice Video Problems.

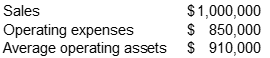

Practice Video Problem 9-1: Profit margin, asset turnover, and ROI

Krisha Patel owns a local accounting and tax firm. She reported the following results for the most recent fiscal year.

Required 1: Compute profit margin, asset turnover, and return on investment (ROI)

Profit margin

Asset turnover

Return on investment (ROI)

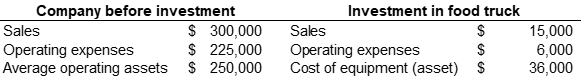

Practice Video Problem 9-2: Computing return on investment (ROI) and residual income for an organization and a project within the organization

Lilo Alana is the owner of the Hawaiian Grill a new restaurant located in a suburb just south of the city. She is considering expanding her operations by purchasing a food truck so she can serve the downtown lunch crowd. Financial data for her most recent year of operations as well as data for the new food truck is provided below. Lilo requires a 15% minimum return on investments.

Required 1: Calculate the return on investment (ROI) and residual income for the company before the investment and the ROI and residual income for the proposed food truck investment.

ROI and residual income company

ROI and residual income food truck investment

Review Questions

Review questions reinforce the chapter content.

Review 9-1

Review 9-2

Review 9-3

Review 9-4

Review 9-5

Review 9-6

Homework

Homework questions can be used for additional practice or can be assigned in an academic setting. Full feedback is not available online. Homework questions can be assigned, with auto-grading and export, to specific learning management platforms, e.g., Canvas, Blackboard, etc. Contact the author for details.

Homework 9-1

Homework 9-2

Homework 9-3

Homework 9-4

Homework 9-5

Homework 9-6